The competition between Airbus and Boeing has been characterized as a duopoly in the jet airliner market since the 1990s. Airbus has taken the lead in the narrowbody jet sales and deliveries with its A220 and A320 series, taking advantage of Boeing’s troubles with its 737 Max. Let’s see who is winning the widebody sales competition.

Boeing and United Airlines announced having reached an agreement for an order of 200 aircraft, including narrowbody and widebody jets. United will bolster its fleet with 200 new aircraft in total: 100 737 Max and 100 Boeing 787s replace its old 767-300ER fleet, with options to purchase 100 more. The Dreamliner deal is the largest order for the type to date, set to be delivered between 2024-2032. In total, United Airlines will now have 530 Boeing aircraft in its backlog, including 430 737 Max aircraft.

Air India is also discussing a large order including widebody jets. It is likely that they could place an order by the end of 2022.

The airlines have been ordering twin engine widebody aircraft for the last five years to replace their less fuel-efficient four engine A380s and 747s. The 2020 Covid 19 health crises certainly accelerated this trend with the drop in demand and the high costs of operating them. Only a few airlines fly them for passenger service. Lufthansa is the largest operator of the 747 in the world, and Emirates is the world’s largest operator of Airbus A380s by a long margin.

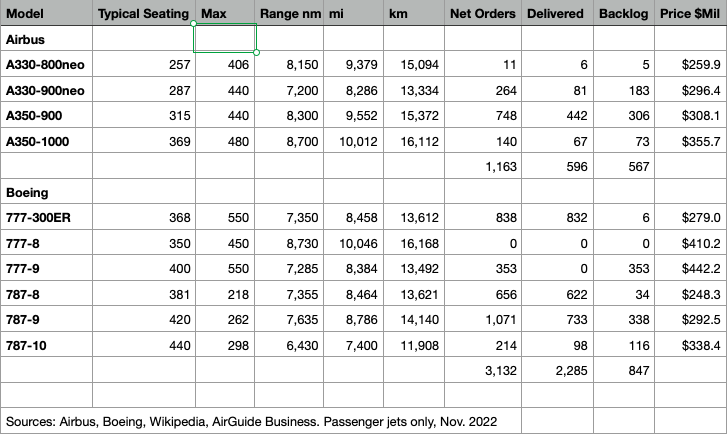

Airbus and Boeing have widebody product ranges covering a variety of combinations of capacity and range. Flight Global fleet forecasts 7,960 twin aisle deliveries for a $1,284 Bn value for the 2016–2035 period, and predict the following market share:

- Boeing 787 series 31%

- Airbus A350 series 27%

- Boeing 777 series 21%

- Airbus A330neo series 7%.

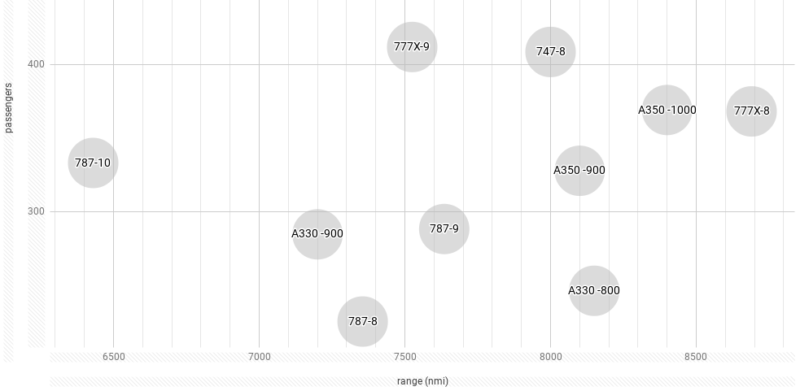

The A350-900 is leader in sales for Airbus with 748 net orders followed by the A330-900neo. Boeing’s sales leader is the 787-9 with 1,071 net orders, followed by the 777-300ER, now replaced by the new 777-8 and -9.

The following graph and table show the widebody product lineup, seating, range, orders and deliveries for Airbus and Boeing as of Nov. 30, 2022. Please note that Boeing no longer sells the 747-8, all other aircraft are in the sales race.

Wide-body aircraft is majorly used in long-haul travel, which is yet to recover from the impact of the COVID-19 pandemic. Although short to medium-haul travel has returned in the U.S. and globally, demand for long-haul travel is expected to remain low in the near to medium-term, according to Fitch Ratings.

Aircraft manufacturers are recognizing the changes the air travel industry is undergoing and taking necessary steps to handle the impact. Boeing has announced it ended production of its 747 aircraft after several airlines announced their plans to retire their 747 and A380 fleets. These aircraft was already facing competition from more efficient twin-engine aircraft.

Our analysis shows that widebody aircraft sales are expected to take two years or more to return to 2019 levels. Airbus CEO recently stated that widebody aircraft demand could recover in 2023 or 2024. However, Boeing has been reporting a lot of activity in the widebody sector since the summer of 2022, especially regarding its negotiations with with United Airlines and Air India for very large orders.

Looking at the current Nov. 2022 data, Boeing is leading with 3,132 orders and a backlog of 847 widebody jets, and Airbus with 1,163 orders and a backlog of 567. The biggest challenge for Boeing will be to deliver the aircraft on order to its clients in 2023 and 2024. Boeing has been extremely challenged with development and delivery delays in 2021 and 2022. It must resolve these issues immediately, otherwise it might see a serious decline in its orders and deliveries, just like it did in the norrowbody market with its 737 Max and the A320 series.

By Brian Davidson, AirGuideBusiness.